stock option tax calculator uk

Exercising your non-qualified stock options triggers a tax. The results provided are an.

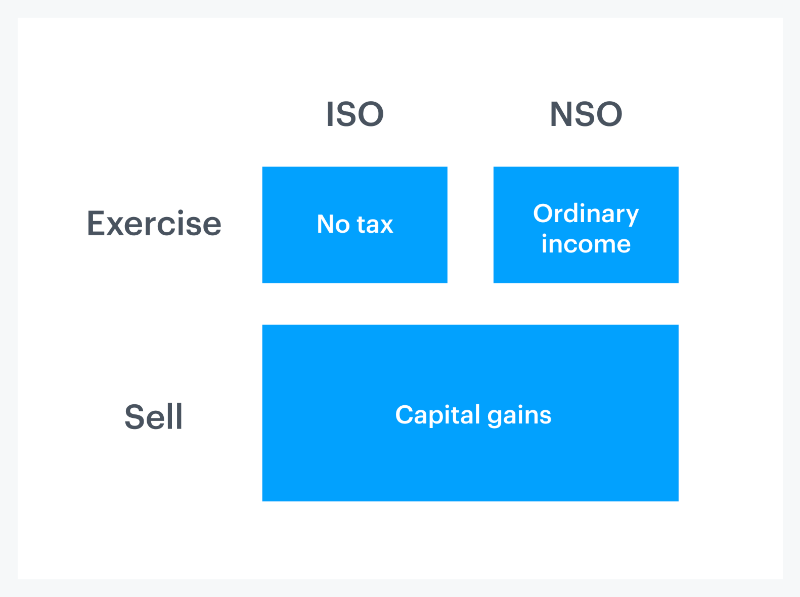

How Stock Options Are Taxed Carta

The same type acquired in the same company on the same date.

. Use our Capital Gains Tax calculator to work out what tax you owe on your investment profits. Since the spread on an NSO is treated as. Just follow the 5 easy steps below.

Taxes for Non-Qualified Stock Options. The tool will estimate how much tax youll pay plus your total return on an ESPP investment under three scenarios. Calculate the value of a call or put option or multi-option strategies.

A Company Share Option Plan CSOP is a tax-advantaged share plan that enables a company to grant market value share options to selected executive directors and employees. When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock. On this page is an employee stock purchase plan or ESPP calculator.

How much are your stock. The Stock Option Plan specifies the employees or class of employees eligible to receive options. Section 1256 options are always taxed as follows.

The Stock Option Plan specifies the total number of shares in the option pool. The Stock Calculator is very simple to use. When the Option is exercised the option gain is subject to income tax up.

Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. Free stock-option profit calculation tool. Ad ETF options taxed as long-term capital gains index options may qualify at 6040 tax rate.

You may be able to work out how much tax to pay on your shares. The grant and vest of the shares follow the description above and neither of these are taxable events. The stock profitloss calculator created by iCalculator will assist you in determining the actual value of the returns on your stock investments.

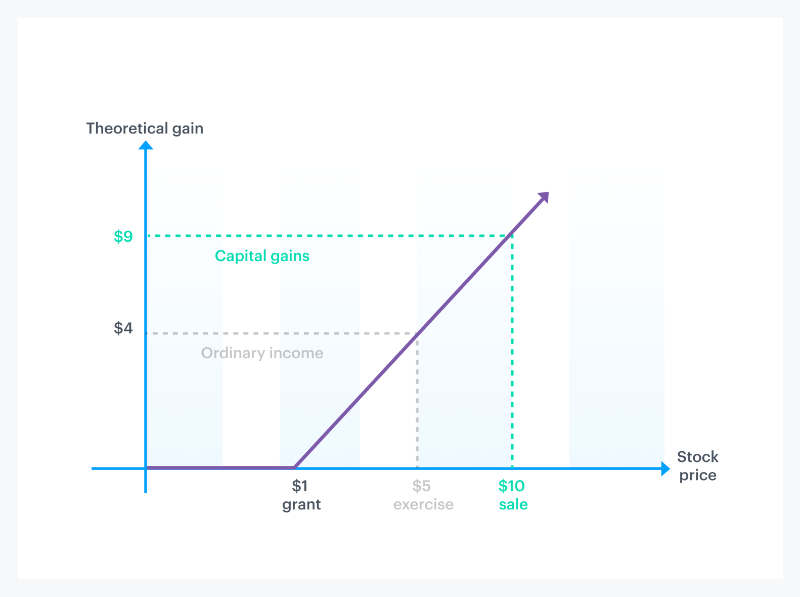

Enter the purchase price per share the selling price per share. Ad ETF options taxed as long-term capital gains index options may qualify at 6040 tax rate. If you sell the stock when the stock price is 10 your theoretical gain is 9 per sharethe 10 stock price minus your 1.

Please enter your option information below to see your potential savings. It can help you in many more ways like. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

Looking to Unlock the Value. This is ordinary wage. Thats the 5 stock price minus your 1 strike price.

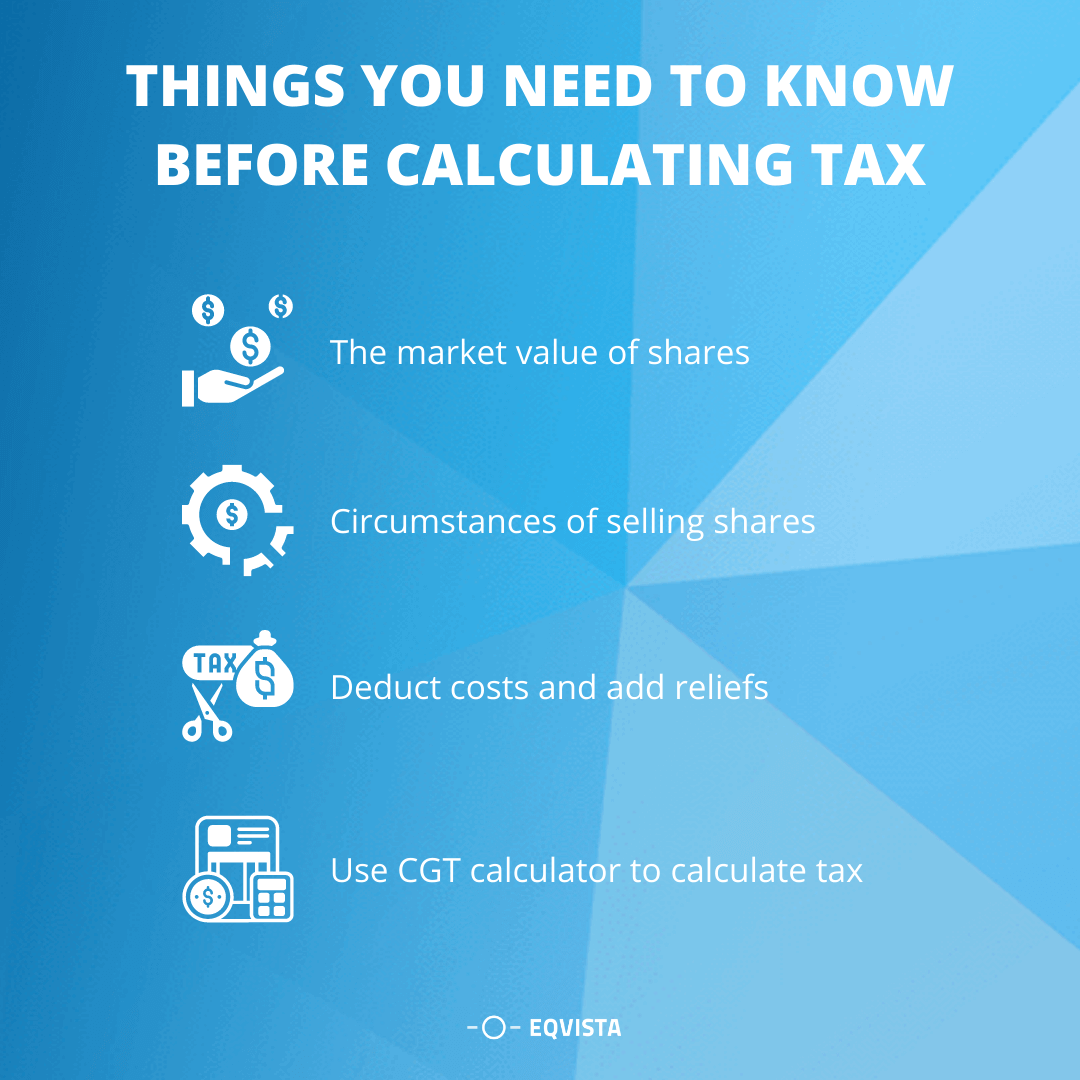

Normal capital gains tax rules apply on the sale and you will pay tax at any gain above the annual exemption at either 18 or 28 depending upon your income elsewhere. You can use the calculator if you sold shares that were. Capital Gains Tax is basically a tax that youre charged on money you make from selling an.

If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between the. See visualisations of a strategys return on investment by possible future stock prices. The issue of stock options under an advantageous plan should also mitigate any social security payable by both the employee and employer as compared to non-qualifying stock options.

Lets say you got a grant price of 20 per share but when you exercise your. This calculator illustrates the tax benefits of exercising your stock options before IPO. Enter the number of shares purchased.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Net Value After Taxes. You can find your federal tax rate here.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Property Rental Income

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

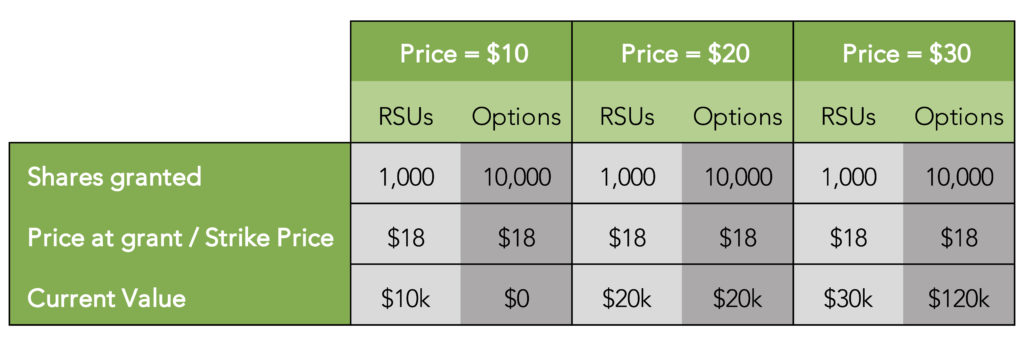

Rsu Taxes Explained 4 Tax Strategies For 2022

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

How Stock Options Are Taxed Carta

Iso Amt Tax Calculator Eso Fund Calculate Employee Stock Options Tax Or Iso Amt Tax Through Eso Fund Our Special Tax Write Offs Tax Deductions Filing Taxes

Land Transfer Tax Calculator A Strong Option To Get Home With Land Transfer Tax Basic Facts Life Facts Home Equity Loan

3 Tools And 15 Sites For Stock Investing In India Like A Boss 2017 Via Drishtikone Accounting Tax Accountant Investing

Taxation Law Assignment Help In Australia Help For Taxation Law Assignment

New Form 26as Is Faceless Hand Holding Of Taxpayers Says Cbdt Income Tax Return Income Tax Tax Return

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Iq Option Fees And Commissions Money Laundering Tax Services Audit