capital gains tax rate 2021

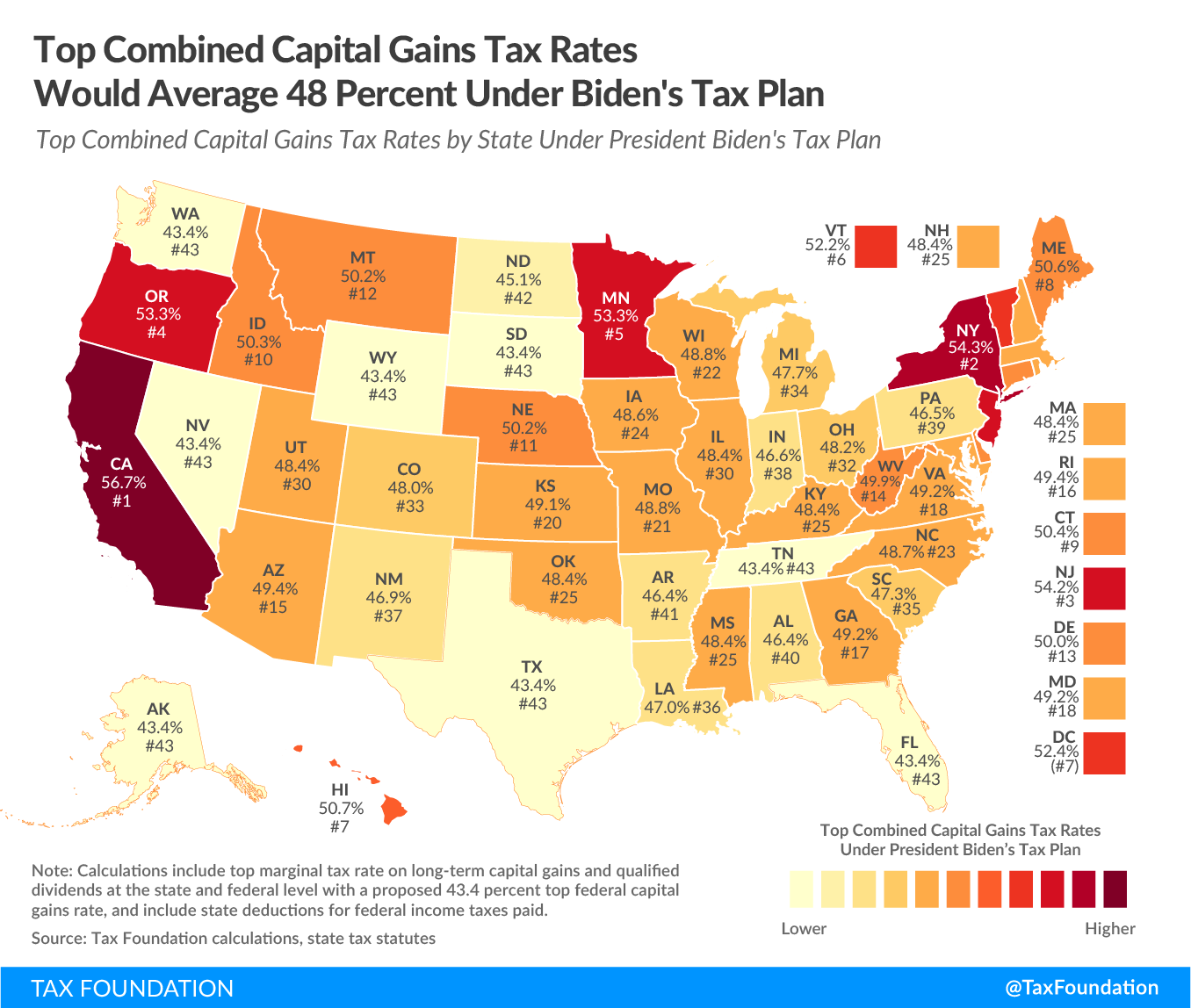

Rates would be even higher in many US. Capital gains on the disposal of assets are included in taxable income.

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

If your taxable income is 47000 and youre filing as a single person youd pay tax at a rate of 15 on those gains making your long-term capital gains tax bill 1200.

. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. Long-term capital gains can apply a.

Maximum effective rate of tax. Tax Rate For real property - 6. 10 and 20 tax rates for individuals not including residential property and carried interest 18 and 28 tax rates for individuals.

The actual rates didnt change for 2020 but the income brackets did adjust slightly. Show more View Detail 2022 to 2023 Capital Gains Tax Short and Long Term. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Rate of CGT. Short-Term Capital Gains Rates. The rate of CGT is 33 for most gains.

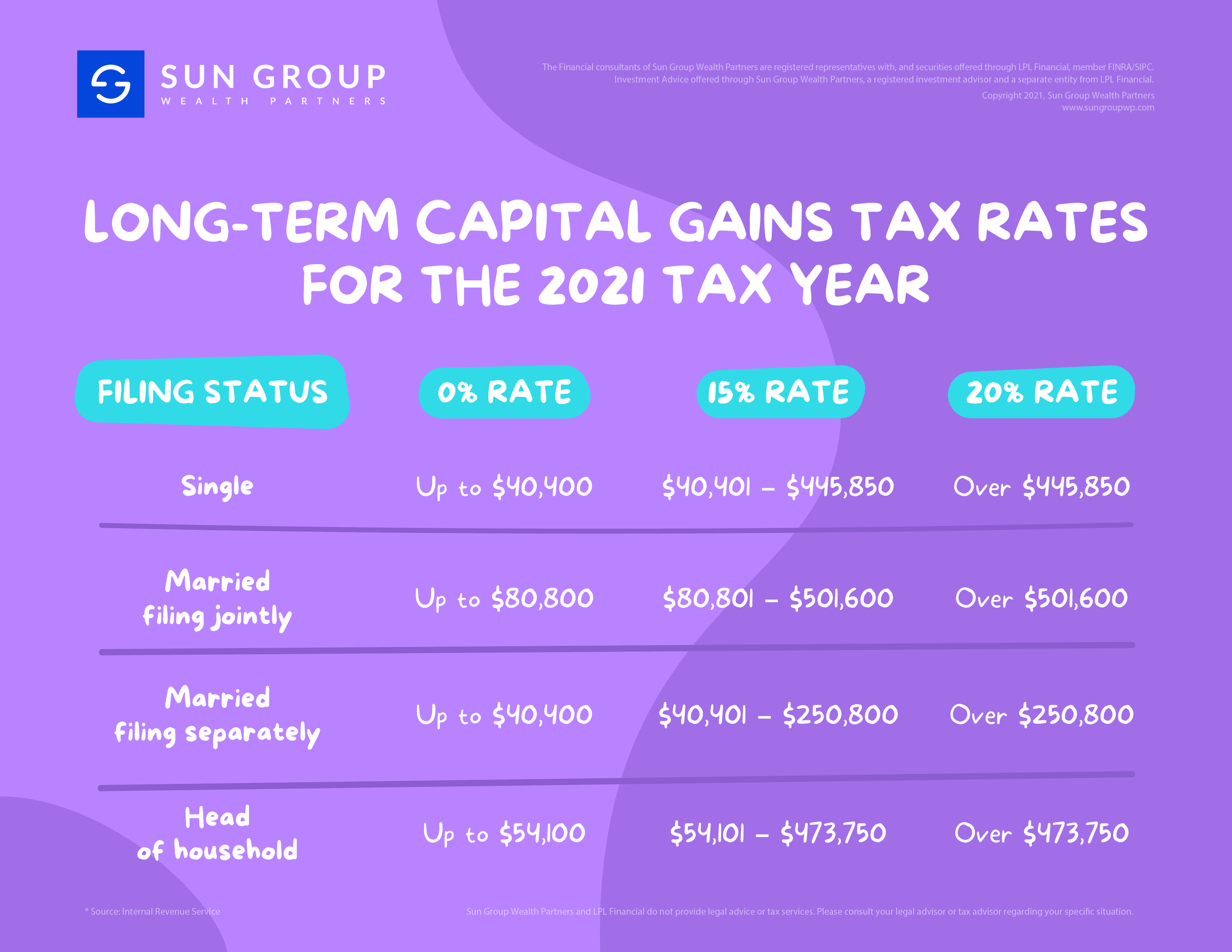

Here are the 2021 capital gains tax brackets and rates. Small business exclusion of capital gains for individuals at least 55 years of age of R18 million when a small business with a market value not exceeding R10 million is. Filing Status 0 rate 15 rate 20 rate.

The built - in gains BIG tax generally applies to C corporations that make an S corporation election and it can be assessed during the five - year period beginning with the first day of the. Wisconsin taxes capital gains as income. Oregon taxes capital gains as income and the rate reaches 99.

Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to. Return to index CAPITAL GAINS TAX FOR ONEROUS TRANSFER OF SHARES OF STOCKS NOT TRADED THROUGH THE LOCAL STOCK EXCHANGE Tax Form. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status excluding.

In 2021 and 2022 the capital gains tax rate is 0 15 or. Depending on your regular income tax bracket your. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more.

Includes short and long-term Federal and State Capital. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. There are other rates for specific types of gains.

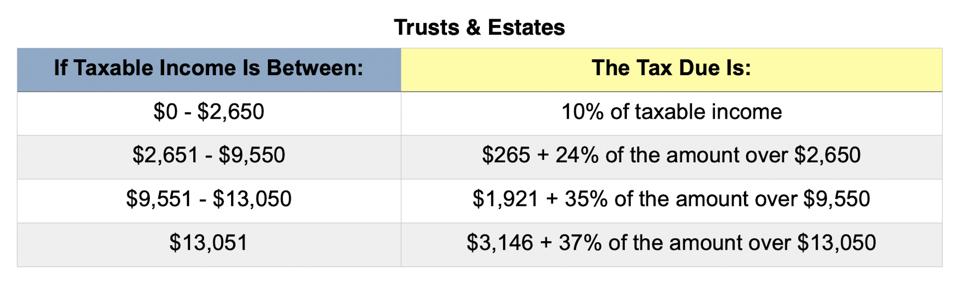

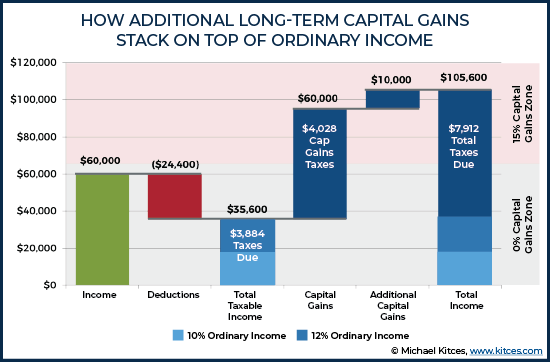

40 for gains from foreign life policies and foreign. Meanwhile for short-term capital gains the tax brackets for ordinary income taxes apply. Add this to your taxable income.

Theyre taxed at lower rates than short-term capital gains. How the 0 Rate Works. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax.

In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single. The following Capital Gains Tax rates apply. In fact long-term capital gains are taxed at either 0 15 or 20 depending on your income and the threshold for each rate can change from one year to the next.

2022 Capital Gains Tax. Because the combined amount of 20300 is less than 37700 the. Long-term capital gains tax rates for the 2021 tax year.

Long-term capital gains are gains on assets you hold for more than one year.

Capital Gains Tax Sensitivity In A Goals Based Framework Glenmede

Capital Gains Tax Definition Taxedu Tax Foundation

Short Term Capital Gains Tax Rates For 2022 And 2021 Smartasset

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

Capital Gains Tax What Is It When Do You Pay It

Understanding The Capital Gains Tax Hereford Financial

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Long Term Capital Gains Tax Rates For The 2021 Tax Year Sun Group Wealth Partners

Rethinking How We Score Capital Gains Tax Reform Bfi

2021 2022 Capital Gains Tax Guide Short And Long Term Sofi

Short Term And Long Term Capital Gains Tax Rates By Income

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

2020 2021 Capital Gains Tax Rates And How To Calculate Your Bill

The Tax Impact Of The Long Term Capital Gains Bump Zone

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan